Peanuts and PBM’s can both help you to die of anaphylaxis.

On allergies and avarice

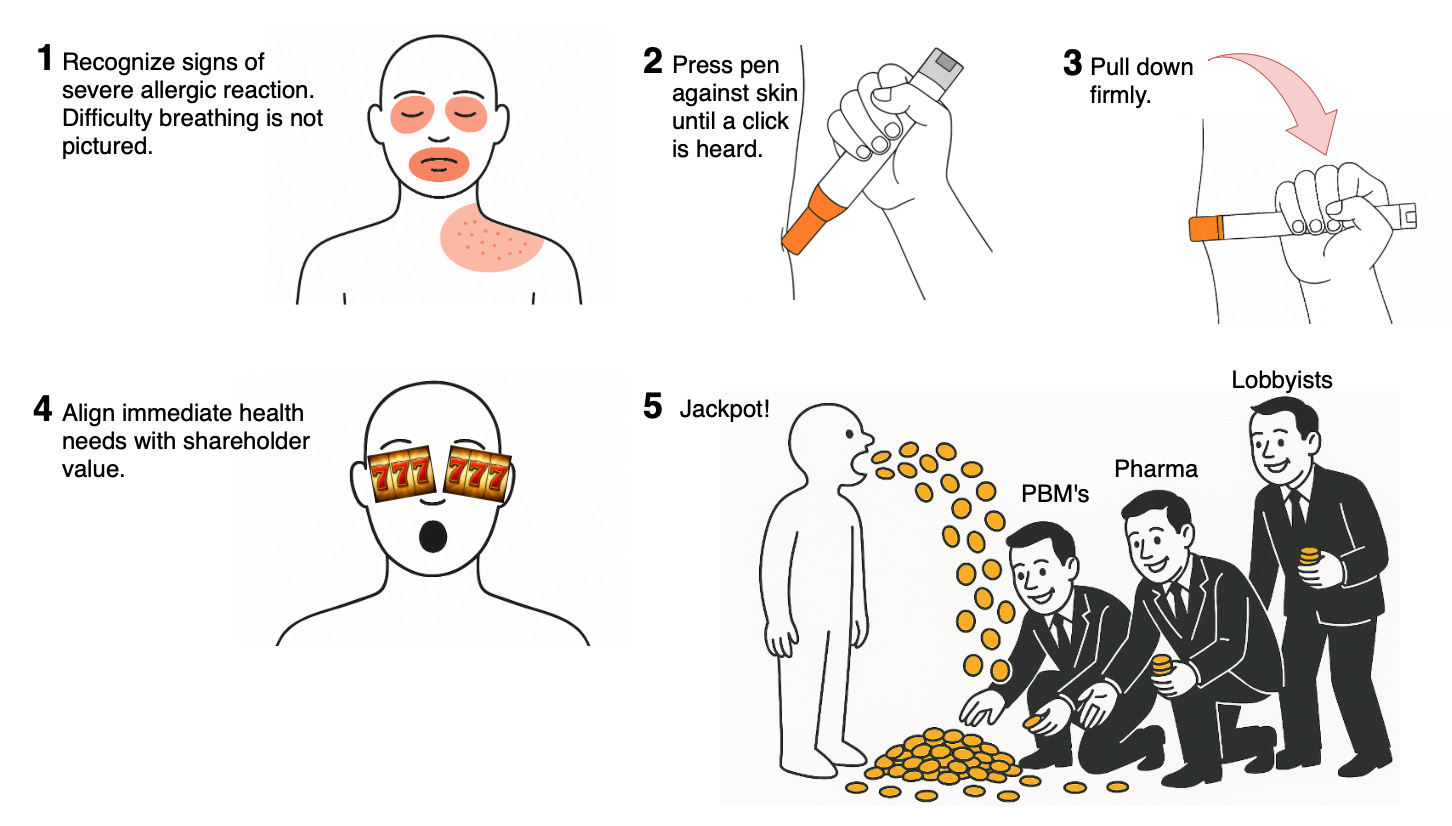

The updated instructions for the proper use of an Epinephrine Autoinjector just hit. I applaud the honesty!

Why am I criticizing Pharma immediately on the heels of writing that we shouldn’t show up on their doorsteps with torches and pitchforks?

As it turns out, Pharma still isn’t really the main villain of this particular tale. When it comes to drug inflation, Pharma is a henchman to a mastermind with a not-so-catchy name: the Pharmacy Benefit Manager, or PBM for short. PBM also stands for Price-Boosting Middlemen, which the easiest way to remember their modern-day purpose, but we will get to that after we examine the deadly allergies that PBM’s have unnecessary made so incredibly expensive to treat.

You can try to walk off a bout of anaphylaxis, but you won’t be walking very far, so rugged independence just isn’t going to cut it here.

I am allergic to boiled vegetables, teen-romance novels, and small arms fire

Self-reported allergies are nearly ubiquitous. About 50% of Americans claim at least one allergy. This doesn’t mean that they actually have any true allergies, as many of these are simply intolerances of the substance they claim to be allergic to.

Intolerances may consist of anything from “not feeling right” to mild gastrointestinal upset or other nonspecific complaints.

I have seen folks who report that “cocaine makes me fell too high,” “epinephrine makes my heart race,” “haldol makes me sleepy,” and “fentanyl made me stop breathing.” I cannot stress enough that these are all things that those drugs are supposed to do via well-understood mechanisms that have NOTHING to do with allergies. Are the reactions real and worthy of note? Absolutely -no cocaine for you, sir! But those are not allergies!

Real allergies are slightly less common: only about 25% of patients have true immune-mediated allergies, and only about 1% of those will have experienced anaphylaxis. Genuine allergies are a threat to life by very specific immune-mediated pathways. I won’t get into it too much, but there are 4 types of immune-mediated reactions that collectively account for all true allergies, with Types I and IV being the most commonly encountered in clinical practice. Type I reactions are the most serious, as they produce anaphylaxis, which can very cleanly kill you via profoundly low blood pressure and an asphyxiating degree of airway constriction.

When your Tinder-date claims they are allergic to latex because condoms make them numb and disappointed, that isn’t the same thing as someone who develops urticarial marks on their skin wherever they are touched by latex gloves -which is only a harbinger of the cardiovascular collapse that full-blown anaphylaxis is about to bring. The former is an intolerance, the latter is a true allergy, and while they will both be filed in the allergy section of one’s medical records -they are not the same.

The molecular basis of allergies is like filing taxes: your first time may have been complicated, but it’s never memorable.

No matter how severe your allergy of today, you had a first time where nothing you were aware of happened. At a molecular level, your T-cells were busy processing the offending antigens and sending memos to mast cells that the very next time they see this antigen again, they are to absolutely lose their shit about it -which is just an easier way of saying degranulate histamine in an escalating, unregulated manner that leads to anaphylaxis and maybe death.

Stupid? Mostly, but cells are brainless; we’re lucky that they do anything at all. Fortunately they do a pretty good job for most people most of the time. It is theorized that hypersensitivity reactions provided some survival advantage against parasites and envenomation, but this comes with the cost of making peanut butter as risky as street-grade fentanyl for some.

In any case, Karen brought cookies to work that she swears contained no peanuts, but forgot that she deep-fried them in peanut oil. Whoops. So now, the only person who knows how to clear a paper jam from the printer is on the breakroom floor convulsing in an unsettling shade of blue. What to do?

Epinephrine, baby! All natural. No preservatives. The OG, carb-, gluten-, and peanut-free catecholamine to the rescue!

Like the perfect antidote, epinephrine counteracts every effect of IgE-mediated hypersensitivity reactions! Through alpha-adrenergic effects, it reduces vasodilation and pathologic vascular permeability, mitigating the inappropriate swelling and hypotension of anaphylaxis. Its beta-adrenergic effects relax bronchial muscle spasm, alleviating wheezing and the very real feeling that you can’t breathe (assuming you are still conscious). It also relieves hives, itchiness, and even the embarrassing gastrointestinal and urinary leakiness caused by severe allergies.

Epinephrine can be administered in almost every conceivable route: IV, IM, SQ, inhaled, and has a delightfully rapid onset of action in each case. You can’t really take it orally in a way that would save your life. It’s too slow and partial digestion makes the dose inadequate. Ditto for rectal administration, so please do not boof epinephrine in an emergency -or even recreationally, as I imagine it will lead to extremely bad (albeit highly-entertaining) consequences that haven’t yet been well-studied.

So surely this ideal, all-natural treatment is super expensive, right?

No. It is super cheap. Epinephrine safer and cheaper to manufacture than it is to extract from the adrenal glands of amped up rioters and road ragers, so don’t get mad that it’s made in a lab. It’s so cheap to make, that the greatest portion of the cost is the sterile water and glass ampule it is stored in.

A 1 mL ampule of 1 mg/mL epinephrine costs between $0.38–$0.55 to manufacture, is sold to a hospital for $1.25–$3.50, leading to a patient charge of $3–$12. So yes, the hospital pays about 4-7 times more than the cost to make it, and you the patient pay about 3-4 times that price. Seems like a rip off when you consider the markup could be as much as 28 times, but $12 for an emergency drug that you may only need once in your whole life isn’t going to price you out of a trailer home.

But as I mentioned earlier, you can’t simply consume epinephrine, you have to inject it somewhere. A common insulin syringe and needle is more than up to the task: that will cost you all of $0.20. I won’t get into the markup there because this is genuinely an insignificant cost.

So the maximum you could pay to deliver a life-saving dose of epinephrine in an emergency to you or your loved one is $12 for 1 mg of epi (which is actually 3 doses worth) + $20 for a single syringe out of a pack of 100. Your total acquisition costs are $32 to get all the stuff you need, but your consumption cost for a single effective treatment is only $4.20. What a deal!

But wait, there’s more!

Let’s say you are too squeamish to poke yourself with that tiny syringe, and you don’t want to measure out 1/3rd of a vial of epinephrine in an emergency. Fine. You’re a pussy, but no judgement. You just want something that is pre-measured at a time that you might be feeling a little panicked, light-headed, and unable to breathe. You want something to automatically deliver all of that adrenal goodness without the scary needle and syringe combo. No worries! Enter the auto-injector!

Boomers and Gen X’s marveled at this theoretical technology in the original Star Trek before it was a thing in real life. A sleek, totally painless system of drug delivery that was as simple as holding it next to someone, followed by a whoosh of ultra-Viagra-cillin that guaranteed Captain Kirk could embark on diplomatic missionary without sweating the details of interstellar child support or the ethics of eradicating a sentient colony of alien herpes.

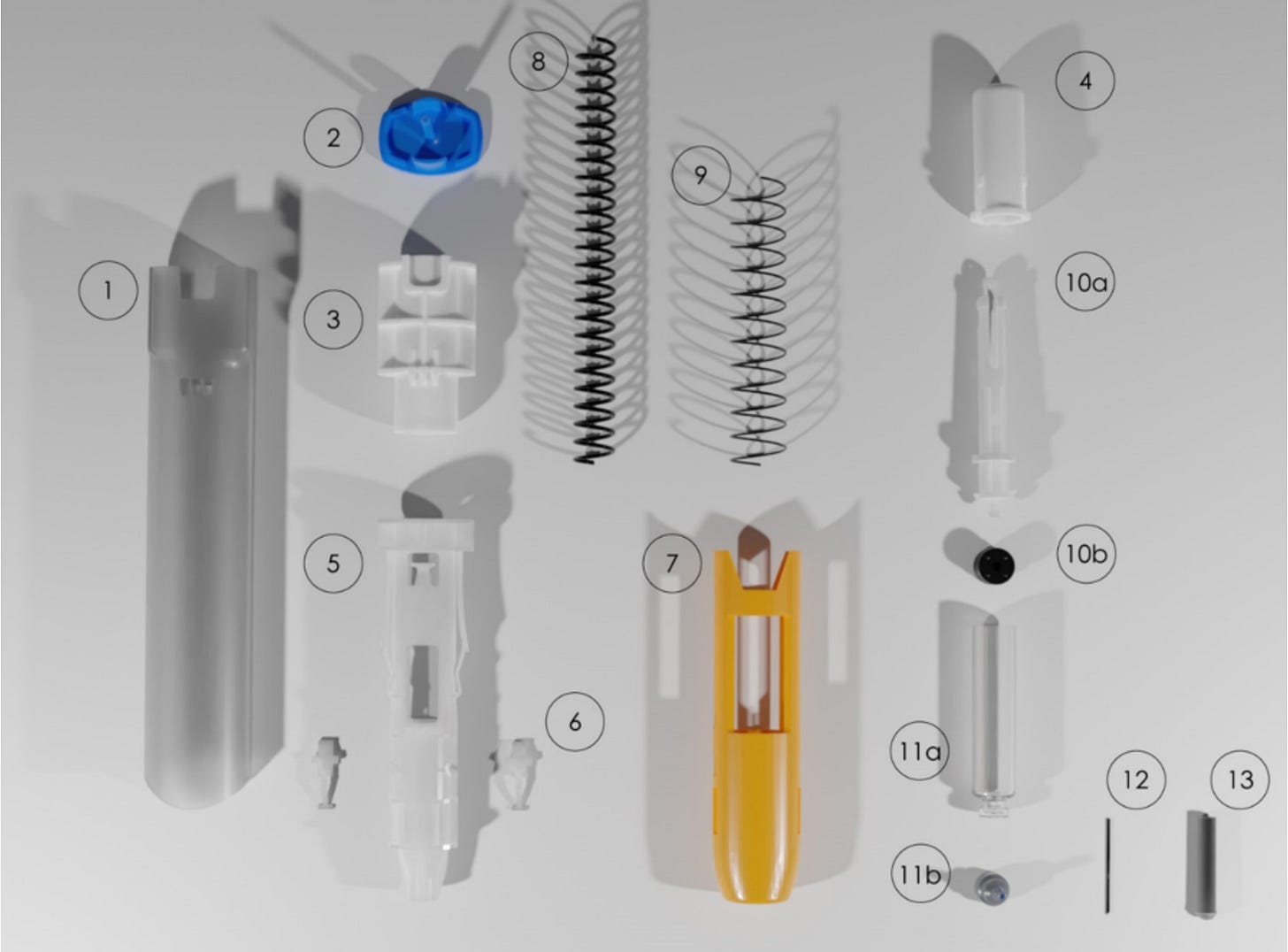

Well… auto injectors aren’t anywhere near as cool as that. They are easy to use (predetermined dose, point and click delivery), but still have a needle on a big fat spring to poke you in a way that is neither magical nor painless. So what is the cost of a lump of plastic, 3 small springs, and 1/3 of an amp of epinephrine?

Anywhere from $300 - $800 for a pack of 2. Holy Balls!

Let’s assume you have lousy pharmacy options and look at the high end -$400 per single-dose pen. That is a markup of over 9,500%! On top of the other markups you paid for the drug itself. Is the device made of gold and tungsten?

Nope. 22.2 grams of mostly ABS plastic. If that sounds fancy, but keep in mind I can use my kid’s 3D printer to make all of these components from scratch for $0.40 per gram, totaling $8.88. That added to a sub-$1 vial of epinephrine doesn’t quite get us to $400. Drug companies have entire injection-molding plants that can build these for a tiny fraction of what the average nerd can print one at home: right around $1.25 a piece. But isn’t it weird that I can construct it in the most expensive way possible at home, and it still isn’t anywhere near as expensive as market asking price? Especially considering that the people doing the asking have access to the cheapest means of producing this product?

Surely something else must make these so expensive?

Two springs and a needle? Anywhere between 15-40 cents.

Additional packaging? Less than 20 cents.

Sterilization, stability, and internal quality control? Less than 20 cents.

FDA compliance documentation? 10 cents. (Honestly, I expected this to be more significant).

Research and development? Epinephrine was first isolated by Jōkichi Takamine in 1901, and mass production for medical use has been common since the 1910’s. Not a lot of new work done there by Pfizer or Mylan. The actual device was approved for use in the US in 1987, and there have been no changes made to the design of the device itself since 2011, when they added a needle cover (not a game-changer).

Lawsuits? To be sure, Mylan has been sued over EpiPens multiple times, but not over the hazards of use (failure to deploy, failure to deliver the correct drug, contaminants causing unexpected problems, etc); from a clinical perspective, the EpiPen is incredibly reliable and very well made. All of the lawsuits that the manufacturer has been subjected to are almost exclusively centered around… wait for it… monopoly-related price-gouging. Who would have known?

Mylan and Pfizer have been sued 7 times since 2017 to the tune of over $1 billion for being sociopathic dickwads who think its cool to fleece an allergy-stricken public for having the nerve to partake in a life-saving ritual that delivers an off-patent, easy to make drug via a toy that is worth less than an equal mass of aluminum foil.

Importantly: even if Mylan and Pfizer passed every penny of their legal settlements to the consumer they were already overcharging, it would only add about $10-$15 per auto-injector. $1B sounds like a lot until you amortize it across the hundreds of millions of units they sold over the same time frame.

An EpiPen is a $2 plastic stapler with 30 cents of drugs, water, and glass inside. They could charge $20 a piece and still afford to sit near Elon Musk in the White House ballroom to watch him balance forks.

Infuriating to be sure, but… WHY?

Greed is such a cliche answer, but to be honest… greed. Pharmaceutical companies play a small part in this, but the biggest culprit is the entity that was specifically invented to keep drug prices low: Pharmacy Benefit Managers. They have created and relentlessly driven soaring drug prices through a unique misalignment of corporate and patient interests.

The secret, beneficent origin story of PBM’s:

PBM’s were originally created in 1968 to act as bargaining agents for patients and insurers, under the incredibly naive notion that patients and insurers have all of their financial incentives aligned -they don’t. Patients want as much free healthcare as they need, and insurers want to collect as much revenue as possible without paying out any healthcare expenses at all. This relationship is inextricably antagonistic, and it only works in a free market when neither side controls a majority of power -which isn’t the case.

The job of a PBM was to:

1. Negotiate lower drug prices on behalf of insurance plans and patients.

2. Create formularies (lists of covered medications) based on cost-effectiveness.

3. Reduce waste by consolidating administrative purchasing efforts.

4. Make sure patients had affordable access to the medications they needed.

PBMs were intended to use their pooled buying power to make drugs cheaper for everyone, by serving as protective financial intermediaries. They made money by charging insurers a small flat fee per prescription ($0.25-$1.00 per claim) in exchange for handling paperwork, making sure pharmacies got paid, and maintaining drug benefit records.

While insurers would also pay PBMs to build formularies to reduce wasteful duplication and to avoid overly expensive medications; their goal was simply to choose clinically sensible drugs at the lowest price. The PBM got no percentage of drug cost, and thus there was no incentive to choose expensive drugs.

Sounds great! What went wrong?

In the early 1990’s PBM’s started to consolidate and mysteriously began favoring brand-name drugs over cheaper generics. By the early 2000’s, they were being strategically acquired by the very companies they were tasked to regulate. Under these vastly distorted conditions, PBM’s became extremely large, powerful, and mission-compromised.

Today, three PBM’s control 80% of all US prescriptions: CVS Caremark, OptumRx (UnitedHealth Group), Express Scripts (Cigna). All three have massive conflicts of interest that they have self-branded as “vertical integration,” which sounds way better than “planned corruption.” UHG and Cigna are monolithic insurance companies, and CVS is a monolithic pharmacy retailer, -all of whom benefit directly from exploiting captive consumers.

With dominant power over the market, incentives flipped. PBMs no longer earned the greatest amount of money by making drugs cheaper (even though they were never intended to be publicly-traded profit-centers). They now generate immense revenue through:

Rebates: Drug makers pay PBM’s a kickback to feature their drugs on a preferred formulary. The larger the rebate, the larger the profit, the higher the final price is for patients.

Spread pricing: PBM’s charge insurers more for drugs than they pay pharmacies to purchase them. The larger the spread, the larger the profit, and the higher the final price is for patients.

Exclusively formularies: PBM’s can block cheaper drugs from appearing on their formularies to protect the revenue they generate from expensive, higher-rebate, higher-spread drugs. Insurance only covers drugs that are on formulary, so cheaper drugs are artificially made more expensive to patients through 100% out-of-pocket costs, redirecting patients back to the drugs PBM’s make money on.

Patients pay copays & deductibles based on inflated list prices, not rebate-discounted prices. Those rebates are not for the unwashed masses, those are for the PBM’s. So even with amazing insurance, the patient feels the financial toll of manufactured inflation.

Unthinkably, instead of negotiating prices down, modern PBM’s negotiate list prices upwards, as it is in their best financial interests.

While PBM’s didn’t start out this way, they are now owned by publicly-traded conglomerates, which means they can no longer act as genuinely independent, neutral negotiators. Their financial incentives come directly from increasing shareholder value, not from reducing patient costs. While this is entirely legal, it is also entirely unethical; and because it is shrouded in a degree of mind-numbing bureaucracy, is subjected to much less public outrage than it deserves.

Let’s look at the corruption of “vertical integration” by each company that proudly claims it as a virtue:

CVS Caremark, CVS Health, and Aetna Insurance are all under the banner of CVS. The current structure of CVS and its subsidiaries allow it to separately extract profit at the pharmacy counter, in the PBM rebate, and in Aetna’s insurance premiums -all of which are supposed to compete with each other to lower prices for the patients, but instead serve to keep list prices for drugs as high as possible. CVS also has the power to design formularies that disadvantage small independent pharmacies, driving more patients to CVS retail locations. Is that the best way for free-market capitalism to care for health consumers?

OptumRx is UnitedHealth Group’s PBM. UnitedHealth owns primary care clinics, urgent care chains, physician staffing companies, and clinical analytic software that evaluates the prescribing patterns of the physicians they own, based on the formulary that they design. UHG maximizes revenue across the every step of your care episode -even deeper than CVS can, given their capture of providers and analytical data. They are incentivized to do anything but minimize drug costs -particularly in light of the rather impressive stock hit they took last April (which they still haven’t recovered from). Gotta get those numbers up, and saving kids choking on their own allergy-induced secretions with low-margin epinephrine just isn’t going to do it.

Cigna can also capture profit at multiple points thanks to Express Scripts and Evernorth: PBM, insurer, specialty pharmacy, and reimbursement negotiations. Their formularies have been structured to favor high-cost specialty drugs, where the margin is greatest. Like the others, their incentives demand the highest monetary yield, not the best value to the patient.

Historical monopolies have been broken up in US history for far less -and even in the absence of any significant harm done. Both financial and health harms have been done by artificial inflation of prescription costs, and it’s gone on for over 20 years.

Strangely, calling this flavor of market manipulation “vertical integration” is like some sort of Jedi mind trick, because investment bros who are personally getting screwed by these companies on their own prescriptions, cheer them on for such bold leadership in vertically integrating:

PBM (waving hand ominously): These are not the drugs you are looking for. You want these ridiculously expensive ones instead, which are identical.

American Day-traders: Oh yeah, my dude! Give me the $400 version of the twenty-five cent drug! My Portfolio is so Rizzed!

Surely Pharma is a bad guy here too?

Yes, but passively so. Pharma’s relationship with PBMs is mutually parasitic. Drug manufacturers don’t like rebate demands from PBM’s, but they depend on PBMs’ to control market access.

PBMs reward Pharma for setting higher list prices with better formulary placement -as long as there is a large rebate to go with that sticker shock. It’s so incredibly corrupt, I am astounded that it is not specifically forbidden, but restrictive laws are for the common folk, not for corporations. It is illegal to have a duck without a permit in Sioux Falls, SD, but it is totally okay for two massive industries to drive up the prices of medications in order to meet their earnings calls.

There are other downstream effects of this arrangement. Pharma silently cooperates with PBM’s demands for rebates because it helps to lock competitors out of preferential formulary placement, especially when it comes to generics and biosimilars. Paying kickbacks in this specific context demonstrates that being a shakedown victim can sometimes come with some pretty stellar benefits!

I don’t have allergies, so I am safe from being ripped off, right?

Don’t worry. If you have ever needed a drug for any reason, PBM’s have you completely protected from the devastating harms of good value! The EpiPen is but a single example made of thousands of instances of sucking you dry.

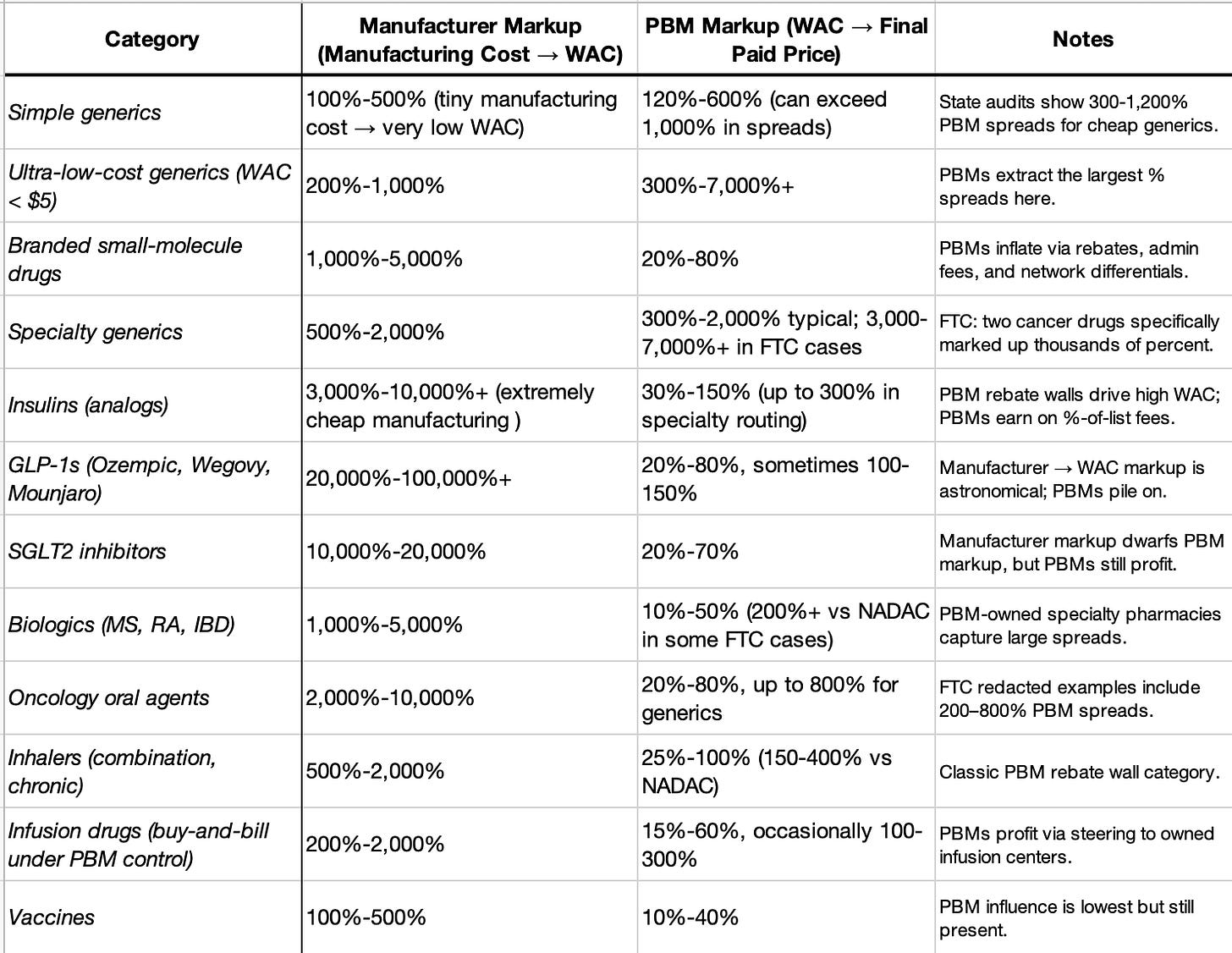

Regulators have already documented that PBM rebate-schemes price most drugs for sale to consumers at hundreds to thousands of percent above their acquisition price (the wholesale price drug manufactures charge pharmacies). Keep in mind, acquisition price already exceeds manufacturing costs by quite a lot. Pharma marks up their manufacturing costs by:

300-1,000% for simple, small-molecule generic drugs

1,000-3,000% for small- to moderate non-generics, and

3,000-6,000% for biologics

…which is passed on to the consumer.

In an ideal world, the drug-store retailer could mark that up modestly enough to thrive and offset the costs of all the stolen Spam and razor blades, but PBM’s have made sure that they will tack on enough to send their own executive staff to cosplay as astronauts on the ISS (which is a lot). For no reason beyond shareholder enrichment, PBM’s multiply already inflated wholesale costs by an additional 100 to 7,000%, always driving drug prices higher for consumers.

Yes -Pharma usually makes the largest mark-ups, and while they could certainly stand to behave more beneficently, consider that they actually make the product and bear the ultimate responsibility for any problems with its use. If your drug doesn’t work, or gives you cancer, or inverts your nipples -the drug manufacturer is getting dragged in the streets for that -not the middleman who shrugs innocently, with pockets cash-stuffed. From the patient’s perspective: the PBM produces nothing, improves nothing, risks nothing, and adds nothing aside from massive additional costs.

WAC = Wholesale Acquisition Cost. All values are evidence-based ranges compiled from JAMA, FTC PBM investigation, state Medicaid audits, GAO reports, and peer-reviewed cost-of-production studies.

The true number of affected drugs is almost certainly in the high hundreds, but the exact figure is impossible to calculate with the current lack of transparency. Just know that it is statistically unlikely that you are not already paying for some middleman’s 3rd home in Aspen.

So much for your happy ending

Whenever you question why you are charged $400 for an EpiPen that costs less than $4 to manufacture, there is a PBM executive or insurance CEO who is questioning why it shouldn’t be $10,000. After all, it is for the good of the shareholder, and who could possibly stop them? The government?

Doubtful. Lobbying by PBM’s and their parents tops $500M per year. Every year. Both parties.

PBM’s are politically insulated from scrutiny because they have wined and dined the key committee members (Finance, Ways & Means, HELP, etc) as well as the trade groups that write model policy language to influence legislation long before it is drafted. Half a billion dollars buys a lot of corruption, and what red-blooded American politician would want to regulate a system that pays for their reelection campaign?

Heck, TurboTax only had to “donate” $3M to eliminate their competition in the form of the US government’s free electronic tax filing system, Direct File. Imagine what 100 times more money can buy you. It sure won’t get you cheaper EpiPens!

Sorry about your child’s hives and impending circulatory collapse; treating that cheaply just doesn’t enhance shareholder value.

Loved it. Like a double feature on allergy myths and PBM mayhem.